- post office rd scheme 2025 details, Calculator

- India Post Recurring Deposit (RD) – Overview

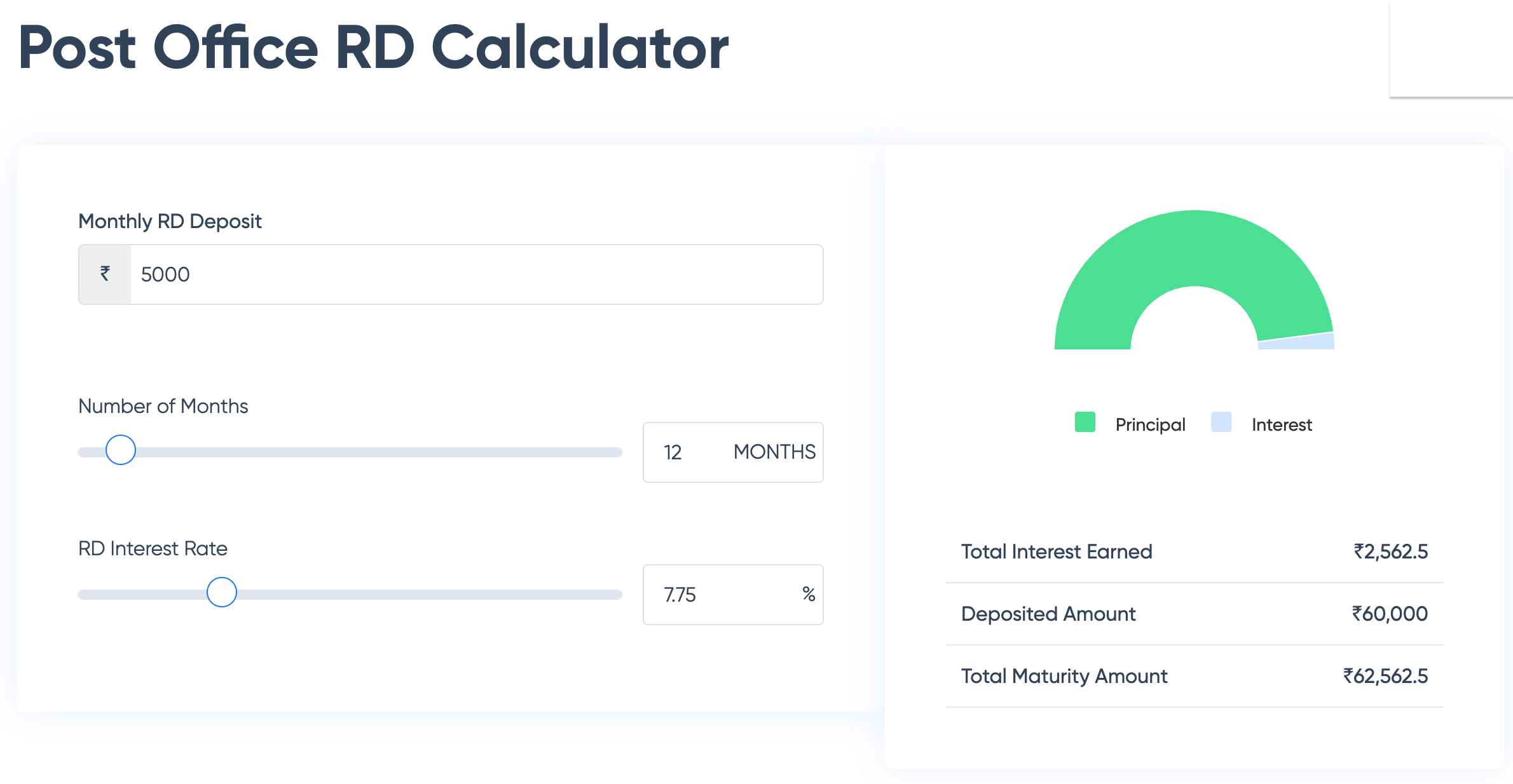

- Post Office: RD Calculator Working

- Post Office RD Calculator: Uses

- Post Office: RD Calculator Formula

- How to calculate Interest on the Post Office RD ?

- Interest and Maturity Amounts Calculation :

- Post Office RD: Features

- Features of India Post RD

- 1. Eligibility :

- 2. Deposits

- 3. Default

- 4. Advance Deposit

- 5. Loan Facility

- 6. Premature Closure

- 7. Maturity & Extension

- 8. Repayment in Case of Account Holder’s Death

- Benefits of Using RD Calculator :

- How to Open a Post Office RD Account?

- Documents Required Post Office Rd Scheme :

- Factors Influencing Recurring Deposit Earnings :

- Closing Post Office: RD Account Online

- Post Office RD scheme 2025 : indiapost.gov.in

Check Post Office Rd Scheme 2025 details, Calculator

post office rd scheme 2025 details, Calculator

In India Post, one can open Recurring Deposit (RD) account, which allows individuals to deposit a fixed amount every month for a specific tenure and earn interest on their savings. The Post Office RD Calculator helps in simplifying calculations. It is a digital tool that helps investors determine the maturity amount and interest earned based on factors like deposit amount, tenure, and interest rate, eliminating manual calculations.

The minimum deposit required to open an RD account is any multiple of Rs. 10 or Rs. 100 per month, with no upper limit on the balance that can maintained. To ensure steady growth of investments, the interest rate is up to 6.2% per annum, compounded quarterly. With an option to extend it for another five years upon submission of a formal application, the standard tenure for the scheme is five years

An RD account can opened in the name of a minor aged 10 years or above. This scheme provides an excellent opportunity to secure a disciplined way to save and grow wealth over time. Read through the complete article to know more !!

India Post Recurring Deposit (RD) – Overview

| Feature | Details |

|---|---|

| Scheme Name | India Post Recurring Deposit (RD) |

| Deposit Frequency | Monthly |

| Minimum Deposit | ₹100 per month or in multiples of ₹10 |

| Maximum Deposit | No upper limit |

| Interest Rate | Up to 6.2% p.a., compounded quarterly |

| Tenure | 5 years (extendable by another 5 years with a formal request) |

| Eligibility | Individuals, including minors aged 10 years or above |

| Calculator Availability | Digital Post Office RD Calculator to compute maturity amount & interest |

| Purpose | Encourages disciplined savings with steady returns |

| Maturity Calculation | Based on deposit amount, tenure, and applicable interest rate |

Post Office: RD Calculator Working

To determine the maturity amount and interest earned based on key input parameters, the Post Office RD Calculator uses a simple formula.

- The principal deposit, tenure, and applicable interest rate are considered.

- For instant result generation, users need to enter these details into the calculator.

Post Office RD Calculator: Uses

It is easy and quick to make use of the Post Office RD Calculator.

- In the respective fields, enter the monthly deposit amount, tenure, and interest rate

- The calculator automatically computes and displays the maturity amount and total interest earned, once the details are provided.

Post Office: RD Calculator Formula

Using the compound interest formula, the RD maturity amount is calculated.

Where:

- M = Maturity Amount

- P = Monthly Deposit Amount

- r = Annual Interest Rate (in decimal)

- n = Number of times interest is compounded in a year

- t = Tenure in years

How to calculate Interest on the Post Office RD ?

- The interest on a Post Office RD is compounded quarterly.

- From the time of account opening the interest rate is fixed and remains constant throughout the tenure.

- Interest includes the principal deposit and previously accumulated interest, which is based on total balance

Interest and Maturity Amounts Calculation :

- Factoring in the initial deposit, tenure, and fixed interest rate, the interest is computed using the compound interest formula.

- Maturity amount is a sum up of the principal deposit and the total interest earned over the selected tenure.

Post Office RD: Features

- Minimum Deposit Amount: ₹100 every month with no maximum limit.

- Tenure – It ranges between 5 years to 10 years.

- Interest Rate – It is fixed at the time of account opening and is compounded quarterly.

- Premature Withdrawal – One can withdraw after 3 years, subject to conditions and penalties.

Benefits of Using RD Calculator :

- It ensures accurate calculations based on the provided inputs.

- It helps users to compare different investment options and choose the best one for their need.

- It is available online for easy access anytime, anywhere.

- It also eliminates manual calculations and providing instant results.

How to Open a Post Office RD Account?

To open a Post Office RD account is easy. Use the following steps :

- Visit the Nearest Post Office that offers RD accounts.

- Get the form from the post office or download it online and fill out the application form.

- Submit Required Documents like KYC documents, including identity proof (Aadhar card, passport, driving license) and address proof (utility bill, rental agreement).

- Attach passport-size photographs as per the application forms provided specifications.

- Make the Initial minimum required amount (₹100 or more) deposit.

- Review and ensure that all the details are accurate before signing the form.

- Account activation will happen after the post office processes the application and activates the RD account.

Documents Required Post Office Rd Scheme :

The following mentioned documents are necessary to open an RD account :

- KYC documents (As a proof of identity) and address proof.

- Passport-size photographs – According to the application form requirements.

- PAN Card – If asked for.

Factors Influencing Recurring Deposit Earnings :

There are several factors that determine the earnings from a Post Office RD which include :

- Deposit Amount – The higher deposits will lead to higher maturity amounts.

- Tenure – There will increased interest accumulation over longer tenure.

- Interest Rate – The overall returns are in turn impacted by the fixed rate at the time of opening.

- Compounding Frequency – The maturity value is enhanced by the quarterly compounding.

Closing Post Office: RD Account Online

- As of now, the Post Office RD accounts cannot closed online.

- You will have to visit the branch where the account was opened to close an RD account.

- A closure request along with the RD passbook needs to submitted.

- The maturity amount will paid to the account holder upon processing.