- apobmms ap bc corporation loans apply online

- apobmms ap bc Loan Scheme 2025 – Overview

- Benefits of AP OBMMS Subsidy Loan :

- AP OBMMS Loans Scheme 2025 :

- Application Process: Guidelines

- AP OBMMS: Online Application Process

- Eligibility Criteria :

- Documents Required :

- APOBMMS Application Status Check :

- Selection Process :

- Getting APOBMMS Beneficiary Status :

- Official Website << apobmms.apcfss.in >> APOBMMS AP BC Corporation Loans

Apply Online for Apobmms Ap Bc Corporation Loans 2025.

apobmms ap bc corporation loans apply online

This year, the government has decided to provide funding support for individuals from the Backward Classes (BC) and Economically Weaker Sections (EWS). An approximate 1.3 lakh Backward Class (BC) and 59,000 Economically Weaker Section (EWS) individuals will receive self-employment subsidy loans. They will no longer need to contribute from their personal funds.

A subsidy will be provided, and the remaining amount will be given as bank loans. The applications for this scheme will be accepted online only through the OBMMS portal. It can be done with the assistance of village and ward secretariat staff.

The eligibility criteria is beneficiaries aged 21-60, individuals falling below the poverty line, can apply for loans for mini-dairy units, livestock farming, traditional crafts, and generic medicine shops. Through geo-tagging and district-level inspections, the government will ensure proper implementation of the schemes. The loan repayments will be monitored locally. Go through the complete article to know more!!

apobmms ap bc Loan Scheme 2025 – Overview

| Feature | Details |

|---|---|

| Scheme Name | Self-Employment Subsidy Loan Scheme |

| Target Beneficiaries | Backward Classes (BC) and Economically Weaker Sections (EWS) |

| Total Beneficiaries | 1.3 lakh BC individuals and 59,000 EWS individuals |

| Personal Contribution | No personal contribution required from beneficiaries |

| Funding Structure | Subsidy provided by the government; remaining amount covered through bank loans |

| Application Mode | Online applications via the OBMMS (Online Beneficiary Monitoring and Management System) portal |

| Assistance for Application | Village and Ward Secretariat staff |

| Eligibility Criteria | Individuals aged 21-60, falling below the poverty line |

| Loan Purpose | Mini-dairy units, livestock farming (sheep, goats), traditional crafts, generic medicine shops |

| Monitoring Mechanism | Geo-tagging of units and district-level inspections |

| Loan Repayment Supervision | Local monitoring by village and ward secretariat staff |

| Implementation Assurance | Government oversight to ensure proper scheme execution |

| Official Website | apobmms.apcfss.in |

Benefits of AP OBMMS Subsidy Loan :

- Targeted Support: Aims to support the youth and women from the backward categories (SC, ST, BC, Kapu, etc.) in Andhra Pradesh. These individuals will receive a zero-interest loan to help them start their businesses.

- DWACRA Scheme: AP YSR Subsidy Loan is one of the parts of the DWACRA (Development of Women and Children in Rural Areas) scheme, aiming to promote rural business growth.

- Goal: Empowering the backward categories and minority communities economically is one of the aims of the scheme.

- Zero-Interest Loan : Zero interest rates charged on the loan amount.

AP OBMMS Loans Scheme 2025 :

| Aspect | Details |

|---|---|

| Total Beneficiaries | 1.30 lakh BCs and 59,000 EWS individuals |

| Beneficiary Contribution | No personal contribution required |

| Subsidy & Loan Structure | Government provides subsidy; remaining amount through bank loans |

| New Guidelines | Beneficiaries no longer need to contribute a portion of the loan amount |

| Implementation Method | Geotagging of self-employment units |

| Verification Process | District-level checks conducted by officials to verify applications |

Application Process: Guidelines

Inviting Applications :

- The applications to BC and EWS Self-Employment Loan Schemes scheduled to start soon.

- A website only dedicated o loan dispursal called Online Beneficiary Monitoring & Management System (OBMMS) has designed for online application submissions.

- Eligible individuals can apply online or with assistance from village and ward secretariat staff.

Documentation and Submission :

- To avoid unnecessary visits to banks, the selection process will be handled at the MPDO or Municipal Commissioner’s office

- After the documents are submitted to the bank for unit establishment, the subsidy amount will be transferred to the bank.

- In the last stage, the total loan amount, including subsidy and bank loan, is deposited into the beneficiary’s account.

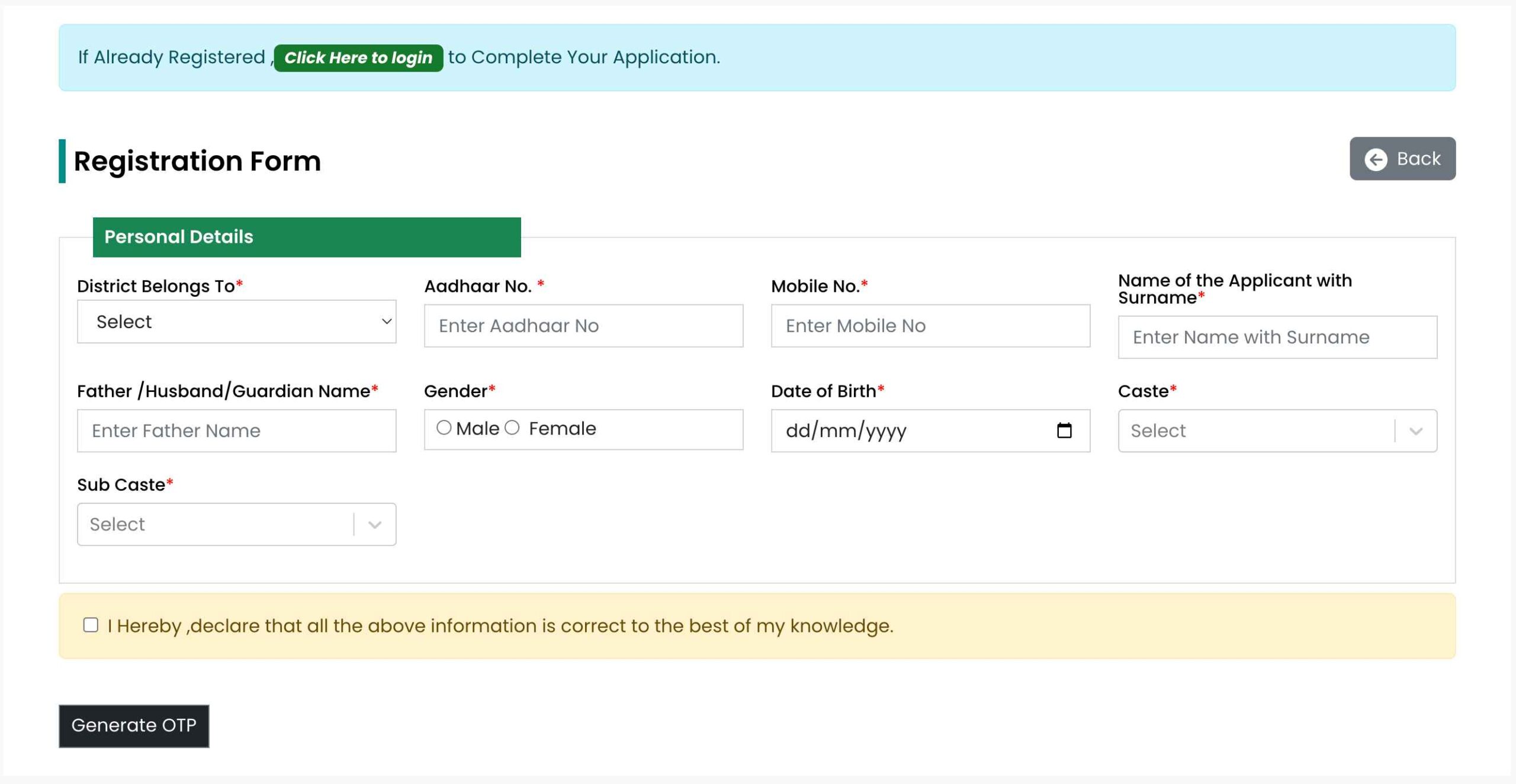

AP OBMMS: Online Application Process

- Go to the Official Website:

- To start the registration process for the AP OBMMS loan type the address .

- Click on “Apply Online”:

- Look for the “Apply online” tab present on the homepage and click on it.

- Choose Desired Application Type:

- From the list of provided corporation applications select the one that applies to you and select whether to apply individually or as a group.

- Relevant Sector and Scheme Choosing :

- Choose the relevant sector (Transport, Agriculture, ISB, etc.) and scheme, then click on the “Go” button.

- Provide Details:

- Enter your district name, Mandal, Panchayat, village, habitation, driving license details (if applicable), and unit cost.

- The website will now calculate the subsidy and loan amounts.

- Bank and Branch Selection:

- See all the bank and branch from the drop-down menu, then enter the desired banks IFSC code.

- Family and Caste Details:

- Enter all the family member details, including the ration card number.

- Select for the beneficiary name and make sure all Aadhaar-related details populated automatically.

- Provide caste details and MeeSeva caste certificate number.

- Residence & Aadhaar Information :

- Give details of residence status and Aadhaar card details, upload a copy of the Aadhaar card.

- Submit Your Application:

- Go through the application and verify the details, now click “Submit” to complete the process. You will then receive an acknowledgment number for future reference.

Eligibility Criteria :

- Residency: The applicants should be permanent residents of Andhra Pradesh.

- Category: The scheme is only accessible for SC, ST, BC, Minority, and KAPU categories.

- Age Limit: Applicants should fall between the range 25 and 66 years of age.

- Eligible Activities: The activities include setting up mini dairy units, sheep/goat farming, Meder, Kummari, Salivahana family businesses, and generic medicine shops.

Documents Required :

- Identity Proof : Any of the mentioned documents, like the Aadhaar card, PAN card, Voter ID, or Driving License.

- Income Certificate

- Caste Certificate

- Birth Certificate

- Bank Account Passbook

- Residential Proof

APOBMMS Application Status Check :

- Check the Official Website: Visit the official website of APOBMMS to trach the status of your application.

- Click on “Get Beneficiary Proceedings”: Now the next step is to enter beneficiary ID, phone number, and date of birth, then click “Get Details” to check the status of your application.

Selection Process :

The MPDO (Mandal Parishad Development Officer) or Municipal Commissioners is responsible for selecting the beneficiaries.

If any ineligible candidates found during the selection, they replaced by eligible individuals.

Getting APOBMMS Beneficiary Status :

- Visit Official Website: Go to the official website to check the beneficiary status.

- Look for “Beneficiary Search”: Click on the Beneficiary Search Tab and enter ration card number, date of birth, beneficiary ID, and corporation name.

- To View Status: Now you can click “Search” to see the APOBMMS beneficiary status displayed on the screen.

Official Website << apobmms.apcfss.in >> APOBMMS AP BC Corporation Loans

CLICK HERE for registration to APOBMMS AP BC Corporation Loans.